-

Gallery of Images:

-

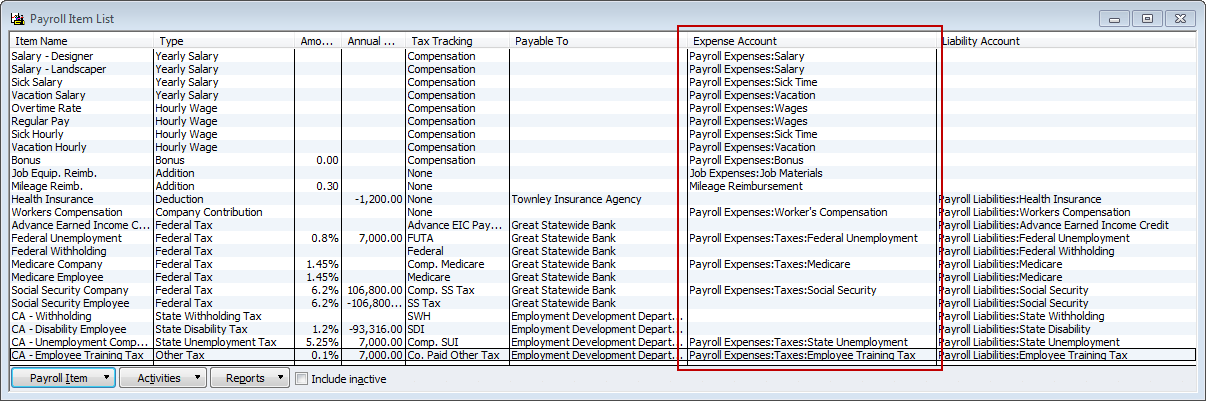

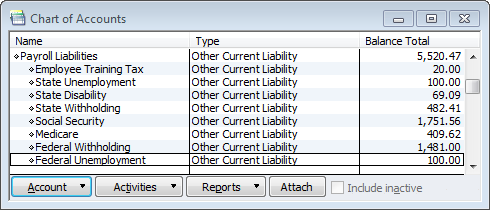

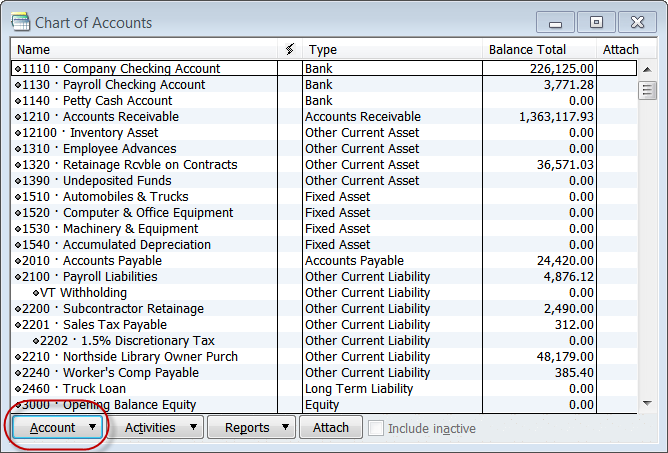

QuickBooks Set Up By a QuickBooks expert in construction accounting to work specifically for Concrete Contractors on whatever year and version of QuickBooks you own because we have worked with QuickBooks since it first arrived in the early 1990's in DOS. The chart of accounts is a listing of all accounts used in the general ledger of an organization. The chart is used by the accounting software to aggregate information into an entitys financial statements. Without a properly structured Chart of Accounts, it is impossible to provide meaningful information to the decision makers. Contractors with a poorly designed Chart of Accountsand thus a poorly designed communication and decision making systemgenerally fail. Contractor Accounting from QuickBooks Enterprise helps you control job costs cash flow with customizable reporting and exception data capacity. Download; Customized Chart of Accounts. Get immediate access to important information like your work in progress, overages and shortages, labor, materials, and more. Hello, I have decided to start tracking my finances with QuickBooks online. I am familiar with QuickBooks and know how to work it, but I would like to hear some input with the chart of accounts. The key to the software is to properly set up the software to meet your needs. You lay out a chart of accounting accounts, buckets to dump data into, then identify your classes of work, create the nine phases of costs (QuickBooks uses item numbers) and finally identify the projects. Quickbooks chart of accounts for contractors fast easy, most quickbooks setup for contractors do not work because of quickbooks setup accounts for your contractor company is wrong the solution is here. This is a dumbed down version of QuickBooks designed specifically for contractors. The Chart of accounts with this version is basically presetup for you, but you can add and remove custom categories as needed. Setting up your Chart of Accounts in QuickBooks correctly varies by industry. Although the businesses are similar, the lists of accounts for real estate development, construction, and fix and flip property have different accounting and reporting needs. need help setting up chart of accounts for new construction. I'm building multiple spec homes and need help setting up chart of accounts for: build money spent. Sample Contractor Chart of Accounts Account List (Modify the Equity accts if LLC or Sole Prop) Account Type Business checking Account Bank Out of Pocket expenses Bank You will receive our QuickBooks advisor discountA savings to you of 15 20 from Intuits price and MSRP. The chart of accounts is a list of asset, liability, equity, income, and expense accounts to which you assign your daily transactions. This list is one of the most important lists you will use in QuickBooks; it helps you keep your financial information organized. QuickBooks Training 2014: How to Set up Chart of Accounts inventory chart of accounts rental property chart of accounts Lastly, keep in mind that the more complicated the Chart of Accounts or Item structure in QuickBooks, the less likely you are to be able to successfully integrate the partner apps on which so much of QBOs functionality depends. Set Up The Chart Of Accounts in QuickBooks. Lesson 18: During the installation of QuickBooks Pro 2013, QuickBooks recommended several accounts to be listed in your chart of accounts. During that time, you had the option of selecting or deselecting the accounts that fit your business needs. The QuickBooks Chart of Accounts is the backbone of your entire accounting system, and its important that you understand how it works. Think of your Chart of Accounts as a filing cabinet with individual files for each type of accounting information that you wish to track. 5 Tips for Tracking Independent Contractors in QuickBooks. Although your business might rely on independent contractors just as much as your employees, the government views them as separate entities and as a result, so does QuickBooks. QuickBooks Desktop Enterprise contractor accounting software tracks job costs, manages estimates, and more. Explore features specific to the construction industry. Get immediate access to important information like your work in progress, overages and shortages, labor, materials, and more. QuickBooks for Contractors Item List and Chart of Accounts in. iif and excel Chart of accounts contractor COGS Only Import into QuickBooks Chart of accounts contractor Import Into QuickBooks Setting up Independent Contractors in QuickBooks So you have their information now you need to set them up in QuickBooks. First, you will need to go to the Vendor Center by clicking the icon or going to Vendors Vendor Center. A chart of accounts is a lot like the game Jenga. If you take a block away from one section of your business, you have to add it back someplace else. The QuickBooks Template File is fully customized and ready to use for a construction company, including an extensive Chart of Accounts, memorized reports, customized forms and much more. QuickBooks makes it easy for you to set up a chart of accounts. Follow its wizard in initially setting up your company in QuickBooks, selecting the appropriate legal form and industry. If you are unable to find your precise industry, select the industry closest to yours; or if you are adventurous, start from scratch. NAHB Chart of Accounts Page 2 of 39 April 2008 Receivables 1210 Accounts receivable, tradeAmounts due to the business for construction, including customers orders for extras, management services, or other services performed Why You Need This Book Three years ago we released Contractor's Guide to QuickBooks 2012, because there had been significant improvements made to QuickBooks since the previous edition. The CHART OF ACCOUNTS is the way in which you organize your accounting information. Think of it as the FILING CABINET holding DRAWERS (Level One) into which you place FILE FOLDERS (Level Two) containing DIVIDERS (Level Three) holding financial information about your business. QuickBooks Premier for Contractors attempts to provide a complete setup including a Chart of Accounts, an Items List, and a Class List that allows the user to avoid many of the decisions that would have to be made setting up QuickBooks Pro. The chart of accounts is something that you have to put some thought into because it is the infrastructure of your enterprise: all the recording of transactions and reporting of assets, liabilities, revenues, and expenses are dependent upon your chart. The chart of accounts should be modified (add or delete accounts) to produce reports that will help you make management decisions in your business. A good foundation for collecting information and reporting on business results is a customized chart of accounts. Govcon Accountants has developed a standard chart of accounts that will pass DCAA audits and is designed for use with Quickbooks. Our chart of accounts will allow for easy computation of your indirect rates with a simple excel template. The chart of accounts is a listing of general ledger accounts organized by account type. QuickBooks, well point out exactly whats new and different. your bank accounts, and your products or services. No data to enter or import right now? You can add it as account in your chart of accounts. Doubleclick the subtotal to see the transactions that make up Job Costing Using WIP Accounts Set up the Chart of Accounts and Item List to track Job Cost codes (page 2). Track Insurance and Workers Compensation Certificates for subcontractors (page 9). For builders and contractors who purchase land and. QuickBooks Accounts For Your Contracting Company Most Contractor QuickBooks Setup Do Not Work! Because someone setup QuickBooks for your Contractor Company using the EZ Step Interview in QuickBooks, the tax accountant or from the notes they took while attending a mindnumbing QuickBooks class or seminar We serve over 100 types of contractors so if your type of company is not listed, please do not be concerned; if you are a contractor, there is a good chance we can help you. Call Sharie now at (206) or email and get the help you need. QuickBooks Enterprise, Premier, Pro for Contractors. Five Steps to Successfully Setting up QuickBooks for Contractors. To modify or add to the chart of accounts, from the Lists menu select Chart of Accounts. If you created your file with the Easy Step Interview, you may already have an established Chart of Accounts. Using QuickBooks for Government Contract Accounting. Configure the Chart of Accounts with Direct and Indirect Costs Part of configuring the Chart of Accounts is to make sure direct expenses are associated with single cost objectives. In an adequate chart of accounts, you should be able to see the difference between direct cost accounts. The QuickBooks Chart of Accounts is the framework used to categorize the information and transactions used to create reports. QuickBooks for Contractors blog by Sunburst Software Solutions, Inc. Chart of Accounts for the Service and Contracting Business Introduction A Chart of Accounts is a list of the financial accounts (bookkeeping) for a business, systematically arranged, generally according to assets, liabilities, equity, income, and expenses. Electrical Contractor sample chart of accounts? Anyone know of a downloadable (free or paid) template chart of accounts anywhere that's geared specifically to. From monthly DCAA compliant accounting services, to contract management administration, and financial services planning for contractors and grantees, our goal is to ensure the success of our clients, and all small business government contractors. Even though the QuickBooks chart of accounts for a company like this might seem simple to set up, it is important to do so correctly to ensure safe and accurate accounting. Electricians, plumbers, masons, welders, landscapers, and carpenters are all examples of construction trades. Landscaping is one of the options and will automatically fill the chart of accounts with landscaperbusiness related income and expense accounts. Use the Spreadsheet Import wizard to import chart of accounts data (account number, account description, account grouping, and balance information) from a. Quickbooks for Government Contracting. We have developed a DCAAcompliant configuration of Quickbooks that provides you with a costeffective yet robust solution for accounting for government contracts while meeting all of the requirements for costreimbursable contracts. Setting up the QuickBooks Chart of Accounts for DCAA compliance and ICAT. For more information about ICAT for QuickBooks. Quickbooks For Plumbing Contractors And The Chart Of Accounts. During QuickBooks setup and especially QuickBooks for Plumbing Contractors one of the. Contractor QuickBooks Desktop New File Setup Or Improve Your Existing Chart of Accounts, Cost Codes, Item Lists. Developed For You By Construction Accountants. Standard Chart of Accounts Account Types QuickBooks Point of Sale. Chart of Accounts Complete list with Descriptions. By Hector Garcia On August 17, Uniforms: Uniforms for employees and contractors; Utilities: Water, electricity, garbage, and other basic utilities expenses. Free Chart of Accounts Download for Construction and General Contractors The foundation of any good accounting system is your chart of accounts (COA) A proper accounts list will enable you to account for income and expenses accurately and will assist your accounting professionals to report on. A contractors chart of accounts is the heart of the accounting system. Of particular importance is the cost of sales section (beginning in the series and ending in )..

-

Related Images: